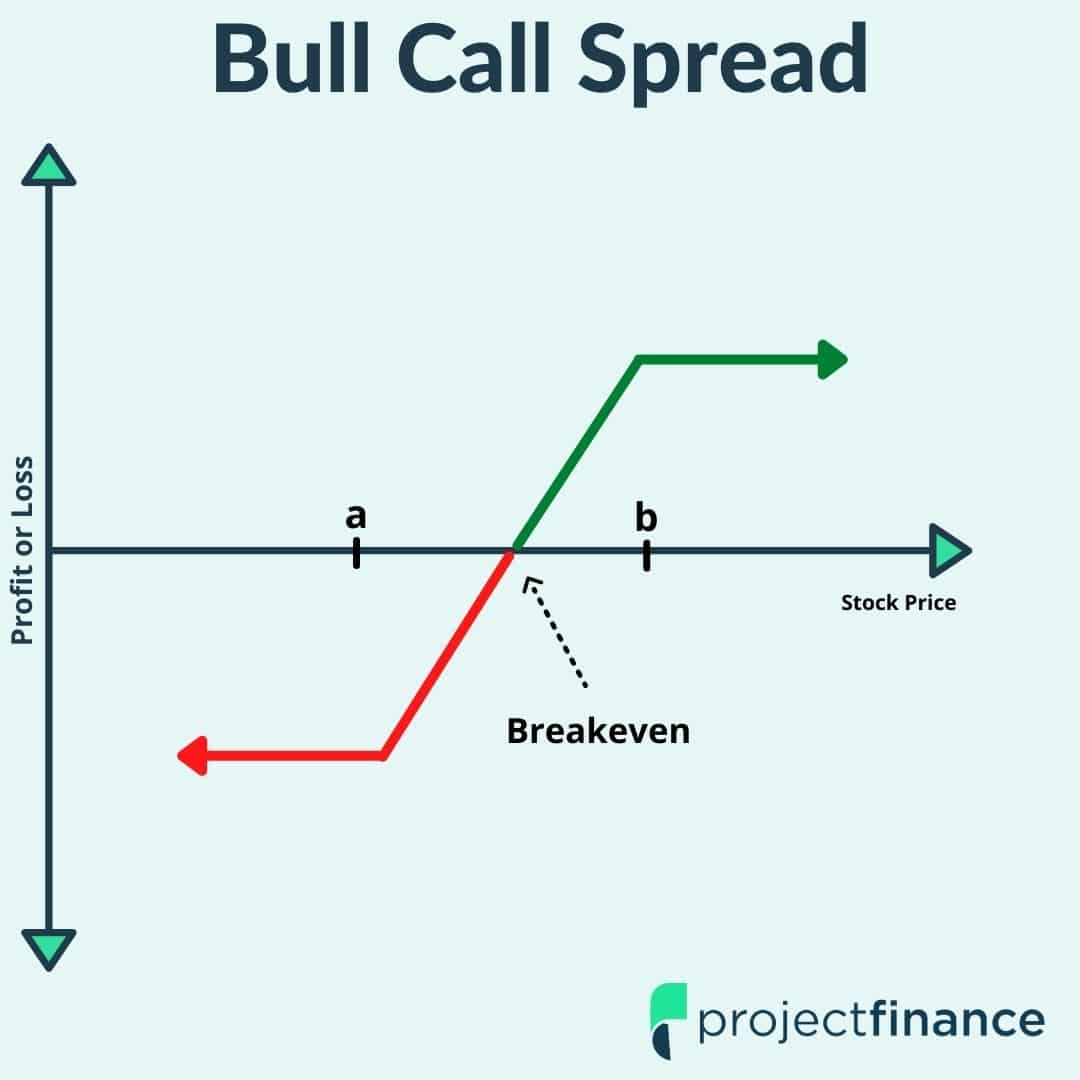

Spread Options Maximum Gain . 14 jun 2024 14 minutes. while a vertical spread caps the maximum gain that can be made from an option position, compared to the profit potential of a stand. a vertical spread options strategy involves buying and selling two options with different strike prices and the same expiration date. the maximum profit is achieved when the price of the underlying is below the short option strike. The maximum gain is capped at the value of the spread minus the initial cost. How to determine potential gains and losses. when trading vertical options spreads, the maximum risk and profit potential are defined and relatively straightforward to calculate. For example, a trader buys a call option. debit spread calculator: their maximum gain is capped at the differences in strike prices, minus the net premium paid. The max loss happens when the price is above the long strike. If the distance between your two strikes.

from www.projectfinance.com

For example, a trader buys a call option. The max loss happens when the price is above the long strike. when trading vertical options spreads, the maximum risk and profit potential are defined and relatively straightforward to calculate. a vertical spread options strategy involves buying and selling two options with different strike prices and the same expiration date. 14 jun 2024 14 minutes. the maximum profit is achieved when the price of the underlying is below the short option strike. If the distance between your two strikes. debit spread calculator: How to determine potential gains and losses. their maximum gain is capped at the differences in strike prices, minus the net premium paid.

Choosing Option Strike Prices for Debit Spreads projectfinance

Spread Options Maximum Gain while a vertical spread caps the maximum gain that can be made from an option position, compared to the profit potential of a stand. 14 jun 2024 14 minutes. If the distance between your two strikes. their maximum gain is capped at the differences in strike prices, minus the net premium paid. while a vertical spread caps the maximum gain that can be made from an option position, compared to the profit potential of a stand. when trading vertical options spreads, the maximum risk and profit potential are defined and relatively straightforward to calculate. The max loss happens when the price is above the long strike. the maximum profit is achieved when the price of the underlying is below the short option strike. How to determine potential gains and losses. debit spread calculator: a vertical spread options strategy involves buying and selling two options with different strike prices and the same expiration date. For example, a trader buys a call option. The maximum gain is capped at the value of the spread minus the initial cost.

From fabalabse.com

What is the max profit on a debit spread? Leia aqui What is the Spread Options Maximum Gain 14 jun 2024 14 minutes. a vertical spread options strategy involves buying and selling two options with different strike prices and the same expiration date. How to determine potential gains and losses. their maximum gain is capped at the differences in strike prices, minus the net premium paid. while a vertical spread caps the maximum gain that. Spread Options Maximum Gain.

From www.investopedia.com

Basic Vertical Option Spreads Which to Use? Spread Options Maximum Gain How to determine potential gains and losses. 14 jun 2024 14 minutes. the maximum profit is achieved when the price of the underlying is below the short option strike. their maximum gain is capped at the differences in strike prices, minus the net premium paid. a vertical spread options strategy involves buying and selling two options with. Spread Options Maximum Gain.

From www.pinterest.com

Ratio spreads are viewed as one of the most dependable longer term Spread Options Maximum Gain The maximum gain is capped at the value of the spread minus the initial cost. If the distance between your two strikes. their maximum gain is capped at the differences in strike prices, minus the net premium paid. 14 jun 2024 14 minutes. the maximum profit is achieved when the price of the underlying is below the short. Spread Options Maximum Gain.

From tradeoptionswithme.com

Options Spreads Explained Complete Guide Trade Options With Me Spread Options Maximum Gain while a vertical spread caps the maximum gain that can be made from an option position, compared to the profit potential of a stand. The max loss happens when the price is above the long strike. For example, a trader buys a call option. a vertical spread options strategy involves buying and selling two options with different strike. Spread Options Maximum Gain.

From www.investopedia.com

10 Options Strategies Every Investor Should Know Spread Options Maximum Gain How to determine potential gains and losses. their maximum gain is capped at the differences in strike prices, minus the net premium paid. while a vertical spread caps the maximum gain that can be made from an option position, compared to the profit potential of a stand. If the distance between your two strikes. debit spread calculator:. Spread Options Maximum Gain.

From www.talkoptions.in

Short Straddle An Option Trading Strategy Spread Options Maximum Gain If the distance between your two strikes. The max loss happens when the price is above the long strike. How to determine potential gains and losses. 14 jun 2024 14 minutes. when trading vertical options spreads, the maximum risk and profit potential are defined and relatively straightforward to calculate. For example, a trader buys a call option. a. Spread Options Maximum Gain.

From robinhood.com

Basic options strategies (Level 2) Robinhood Spread Options Maximum Gain the maximum profit is achieved when the price of the underlying is below the short option strike. How to determine potential gains and losses. when trading vertical options spreads, the maximum risk and profit potential are defined and relatively straightforward to calculate. For example, a trader buys a call option. their maximum gain is capped at the. Spread Options Maximum Gain.

From quantpedia.com

What's the Relation Between Grid Trading and Delta Hedging? QuantPedia Spread Options Maximum Gain The max loss happens when the price is above the long strike. 14 jun 2024 14 minutes. For example, a trader buys a call option. How to determine potential gains and losses. while a vertical spread caps the maximum gain that can be made from an option position, compared to the profit potential of a stand. debit spread. Spread Options Maximum Gain.

From www.simplertrading.com

Options Spreads 101 A Beginner’s Guide Simpler Trading Spread Options Maximum Gain The max loss happens when the price is above the long strike. when trading vertical options spreads, the maximum risk and profit potential are defined and relatively straightforward to calculate. How to determine potential gains and losses. the maximum profit is achieved when the price of the underlying is below the short option strike. For example, a trader. Spread Options Maximum Gain.

From www.nuvamawealth.com

Box Spread Diagram Edelweiss Spread Options Maximum Gain 14 jun 2024 14 minutes. while a vertical spread caps the maximum gain that can be made from an option position, compared to the profit potential of a stand. The maximum gain is capped at the value of the spread minus the initial cost. their maximum gain is capped at the differences in strike prices, minus the net. Spread Options Maximum Gain.

From www.projectfinance.com

3 Best Credit Spread for Options Strategies projectfinance Spread Options Maximum Gain The maximum gain is capped at the value of the spread minus the initial cost. 14 jun 2024 14 minutes. If the distance between your two strikes. a vertical spread options strategy involves buying and selling two options with different strike prices and the same expiration date. when trading vertical options spreads, the maximum risk and profit potential. Spread Options Maximum Gain.

From optionstradingiq.com

what is a ratio spread Options Trading IQ Spread Options Maximum Gain when trading vertical options spreads, the maximum risk and profit potential are defined and relatively straightforward to calculate. The max loss happens when the price is above the long strike. For example, a trader buys a call option. If the distance between your two strikes. debit spread calculator: a vertical spread options strategy involves buying and selling. Spread Options Maximum Gain.

From www.investopedia.com

Which Vertical Option Spread Should You Use? Spread Options Maximum Gain For example, a trader buys a call option. a vertical spread options strategy involves buying and selling two options with different strike prices and the same expiration date. debit spread calculator: The maximum gain is capped at the value of the spread minus the initial cost. the maximum profit is achieved when the price of the underlying. Spread Options Maximum Gain.

From blog.elearnmarkets.com

What Are Bull Call Spread Strategy In Options Trading? ELM Spread Options Maximum Gain If the distance between your two strikes. their maximum gain is capped at the differences in strike prices, minus the net premium paid. For example, a trader buys a call option. How to determine potential gains and losses. while a vertical spread caps the maximum gain that can be made from an option position, compared to the profit. Spread Options Maximum Gain.

From www.macroption.com

Put Ratio Spread Option Strategy Macroption Spread Options Maximum Gain when trading vertical options spreads, the maximum risk and profit potential are defined and relatively straightforward to calculate. The max loss happens when the price is above the long strike. How to determine potential gains and losses. The maximum gain is capped at the value of the spread minus the initial cost. their maximum gain is capped at. Spread Options Maximum Gain.

From optionalpha.com

Bull Call Spread Option Strategy Guide Spread Options Maximum Gain while a vertical spread caps the maximum gain that can be made from an option position, compared to the profit potential of a stand. debit spread calculator: The max loss happens when the price is above the long strike. For example, a trader buys a call option. The maximum gain is capped at the value of the spread. Spread Options Maximum Gain.

From optionstradingiq.com

ratio spread Options Trading IQ Spread Options Maximum Gain If the distance between your two strikes. the maximum profit is achieved when the price of the underlying is below the short option strike. How to determine potential gains and losses. a vertical spread options strategy involves buying and selling two options with different strike prices and the same expiration date. their maximum gain is capped at. Spread Options Maximum Gain.

From www.projectfinance.com

Choosing Option Strike Prices for Debit Spreads projectfinance Spread Options Maximum Gain while a vertical spread caps the maximum gain that can be made from an option position, compared to the profit potential of a stand. If the distance between your two strikes. 14 jun 2024 14 minutes. The max loss happens when the price is above the long strike. their maximum gain is capped at the differences in strike. Spread Options Maximum Gain.